Keep all records of employment for at least four years. There are specific employment tax records you must keep. Canceled checks or other documents that identify payee, amount, and proof of payment/electronic funds transferred.

The following documents may show this information. Deductions taken for casualty losses, such as losses resulting from fires or storms.Documents for assets should show the following information:

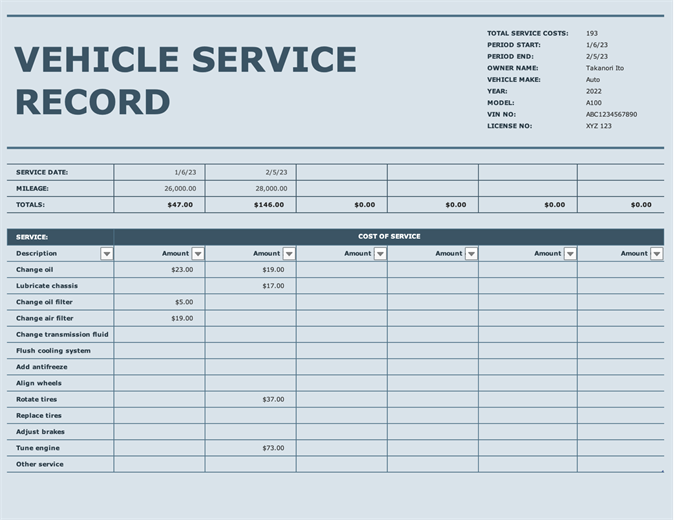

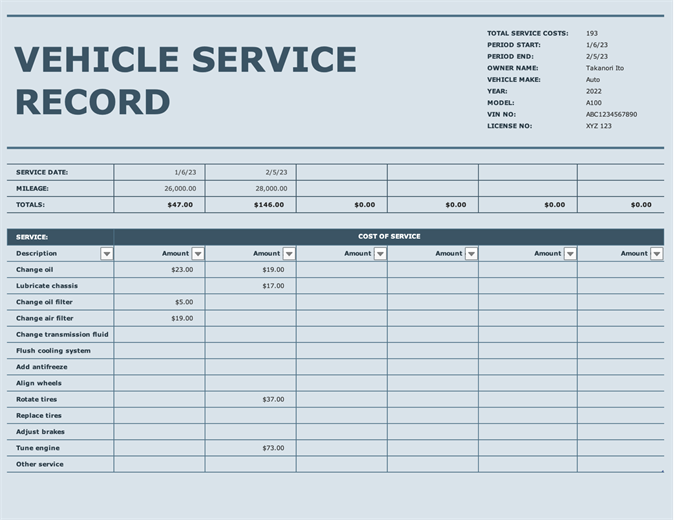

You need records to compute the annual depreciation and the gain or loss when you sell the assets. You must keep records to verify certain information about your business assets.

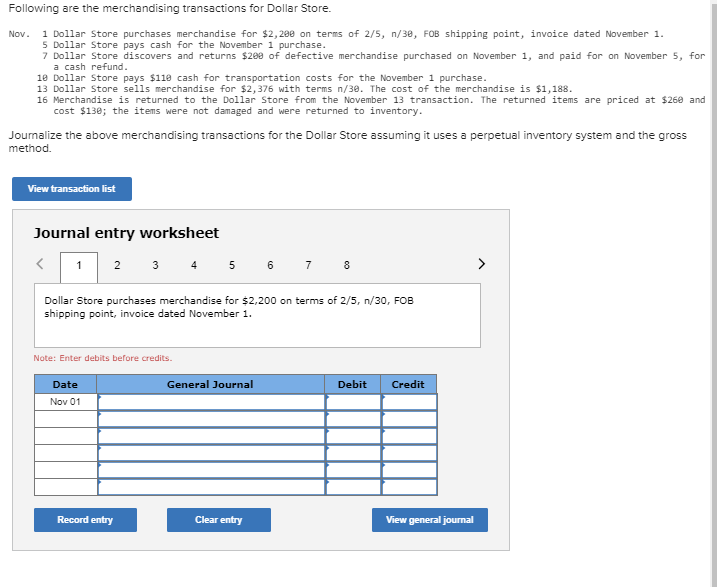

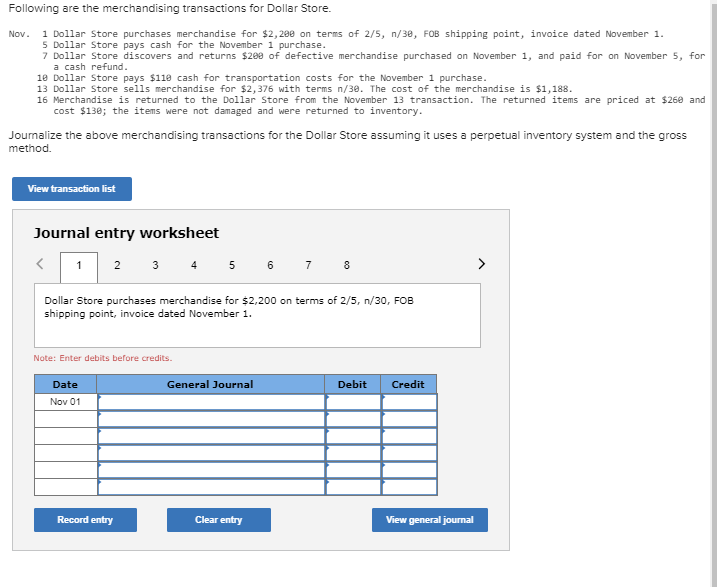

Assets are the property, such as machinery and furniture, that you own and use in your business. For additional information, refer to Publication 463, Travel, Entertainment, Gift, and Car Expenses. If you deduct travel, entertainment, gift or transportation expenses, you must be able to prove (substantiate) certain elements of expenses. Travel, Transportation, Entertainment, and Gift Expenses Note: A combination of supporting documents may be needed to substantiate all elements of the expense. Documents for expenses include the following: Your supporting documents should identify the payee, the amount paid, proof of payment, the date incurred, and include a description of the item purchased or service received that shows the amount was for a business expense. Expenses are the costs you incur (other than purchases) to carry on your business. Note: A combination of supporting documents may be needed to substantiate all elements of the purchase. Canceled checks or other documents reflecting proof of payment/electronic funds transferred. Documents for purchases include the following: Your supporting documents should identify the payee, the amount paid, proof of payment, the date incurred, and include a description of the item to show that the amount was for purchases. If you are a manufacturer or producer, this includes the cost of all raw materials or parts purchased for manufacture into finished products. Purchases are the items you buy and resell to customers. Deposit information (cash and credit sales). Documents for gross receipts include the following: You should keep supporting documents that show the amounts and sources of your gross receipts. Gross receipts are the income you receive from your business. The following are some of the types of records you should keep: For instance, organize them by year and type of income or expense. You should keep them in an orderly fashion and in a safe place. It is important to keep these documents because they support the entries in your books and on your tax return. These documents contain the information you need to record in your books. Supporting documents include sales slips, paid bills, invoices, receipts, deposit slips, and canceled checks. Purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. For more detailed information refer to Publication 583, Starting a Business and Keeping Records. All requirements that apply to hard copy books and records also apply to electronic records. Auto summarize records software#

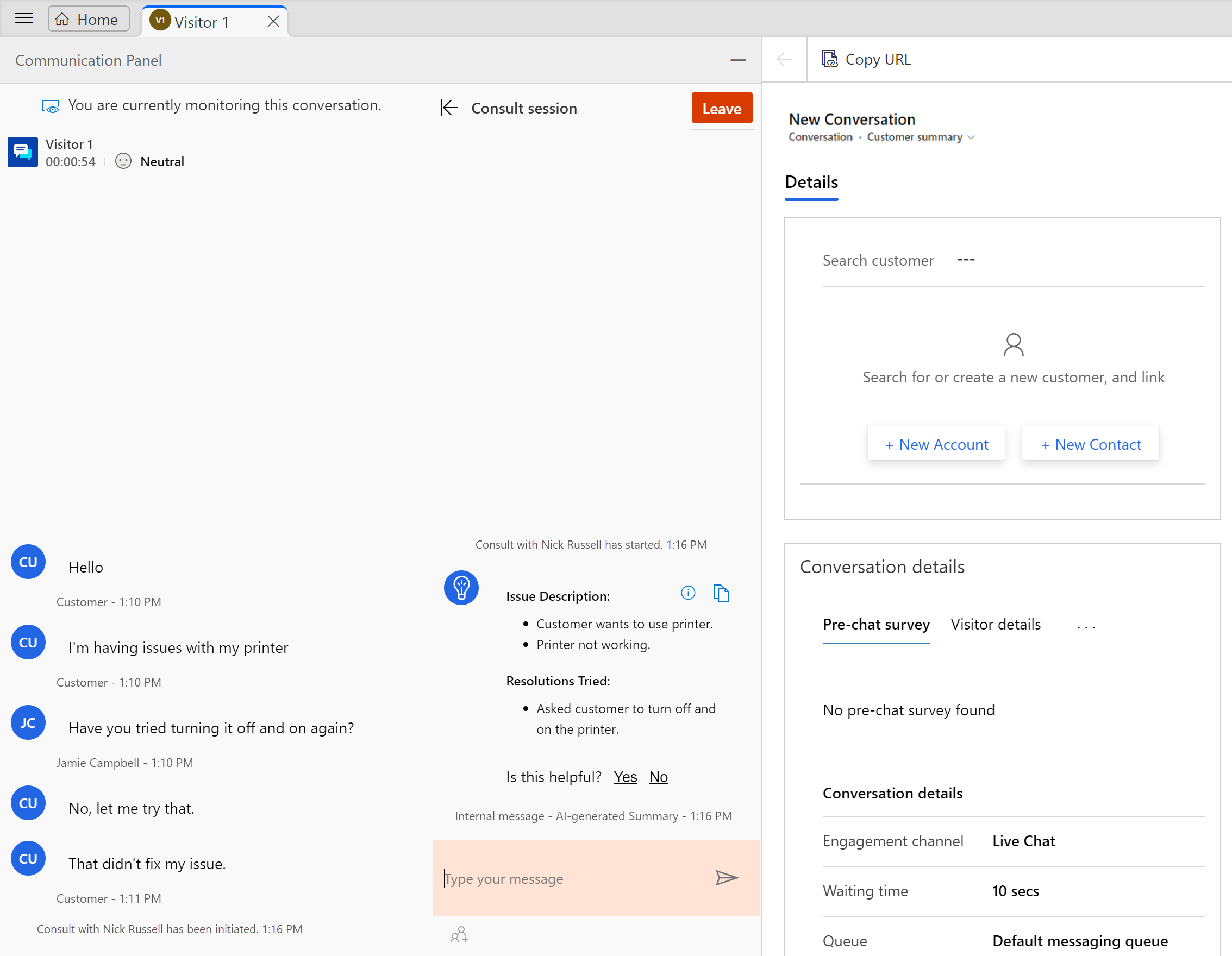

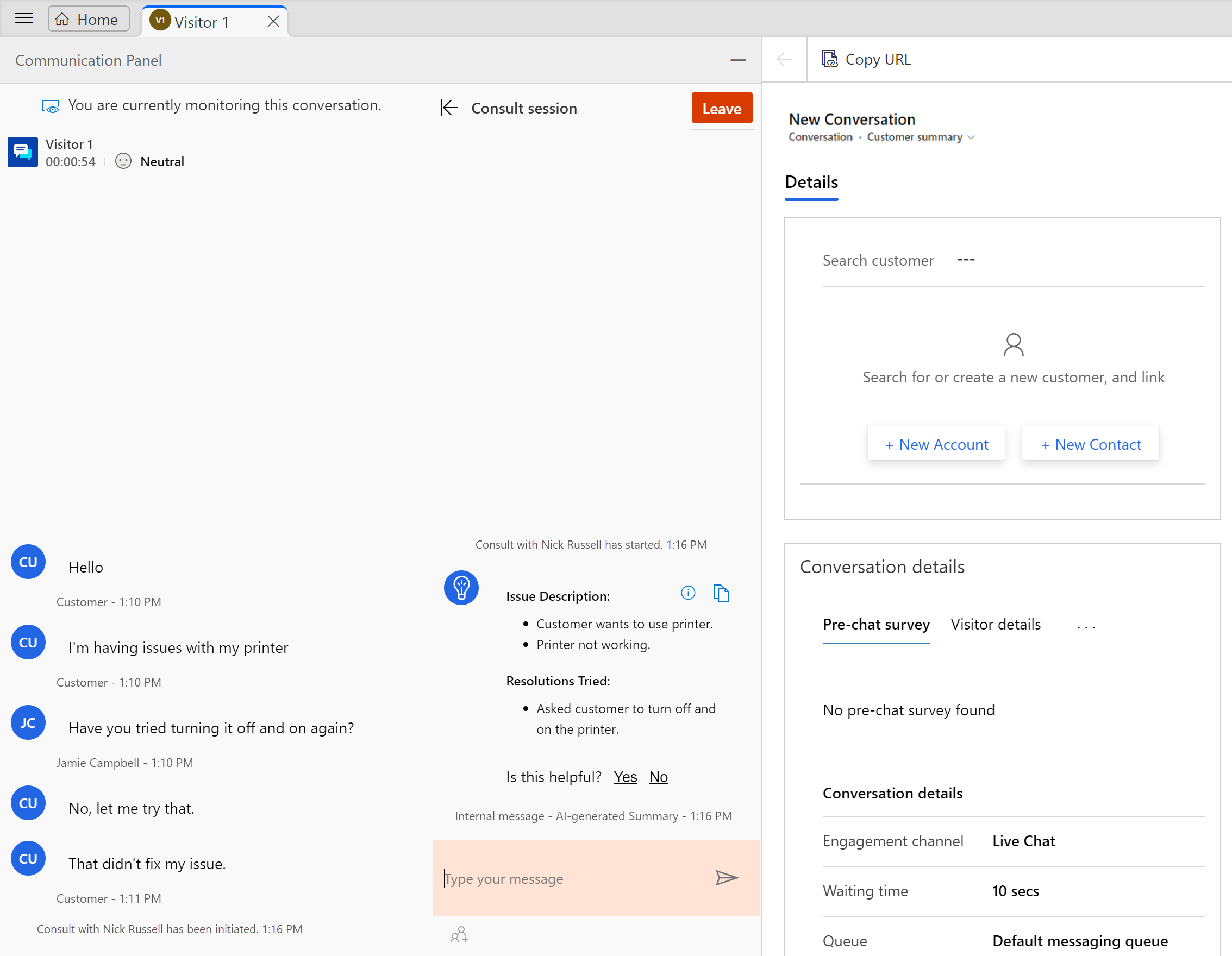

The electronic accounting software program or electronic system you choose should meet the same basic recordkeeping principles mentioned above. Some businesses choose to use electronic accounting software programs or some other type of electronic system to capture and organize their records.

For most small businesses, the business checking account is the main source for entries in the business books. Your books must show your gross income, as well as your deductions and credits. This summary is ordinarily made in your business books (for example, accounting journals and ledgers). Your recordkeeping system should include a summary of your business transactions. The business you are in affects the type of records you need to keep for federal tax purposes. You may choose any recordkeeping system suited to your business that clearly shows your income and expenses.

0 kommentar(er)

0 kommentar(er)